A basic listing of financial ratios including leverage, gross margin, asset turnover and more

Financial Ratios for Financial Statement Analysis. Book Value of Equity Per Common Share = Book Value of Equity for Common Stock / Number of Common Shares

Solvency and liquidity are equally important for a company’s financial health.

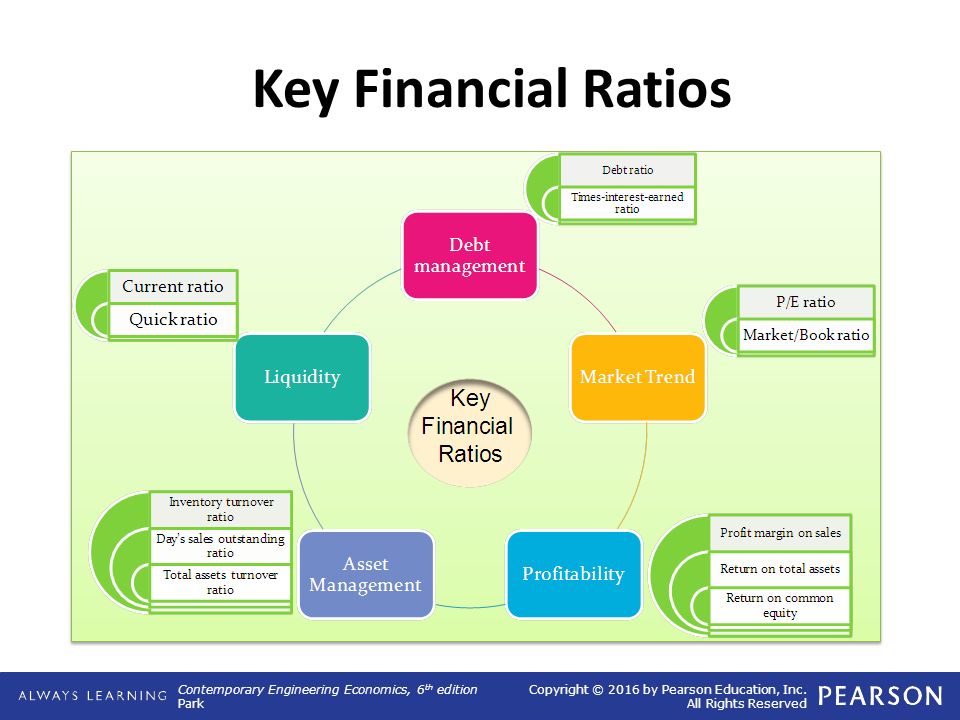

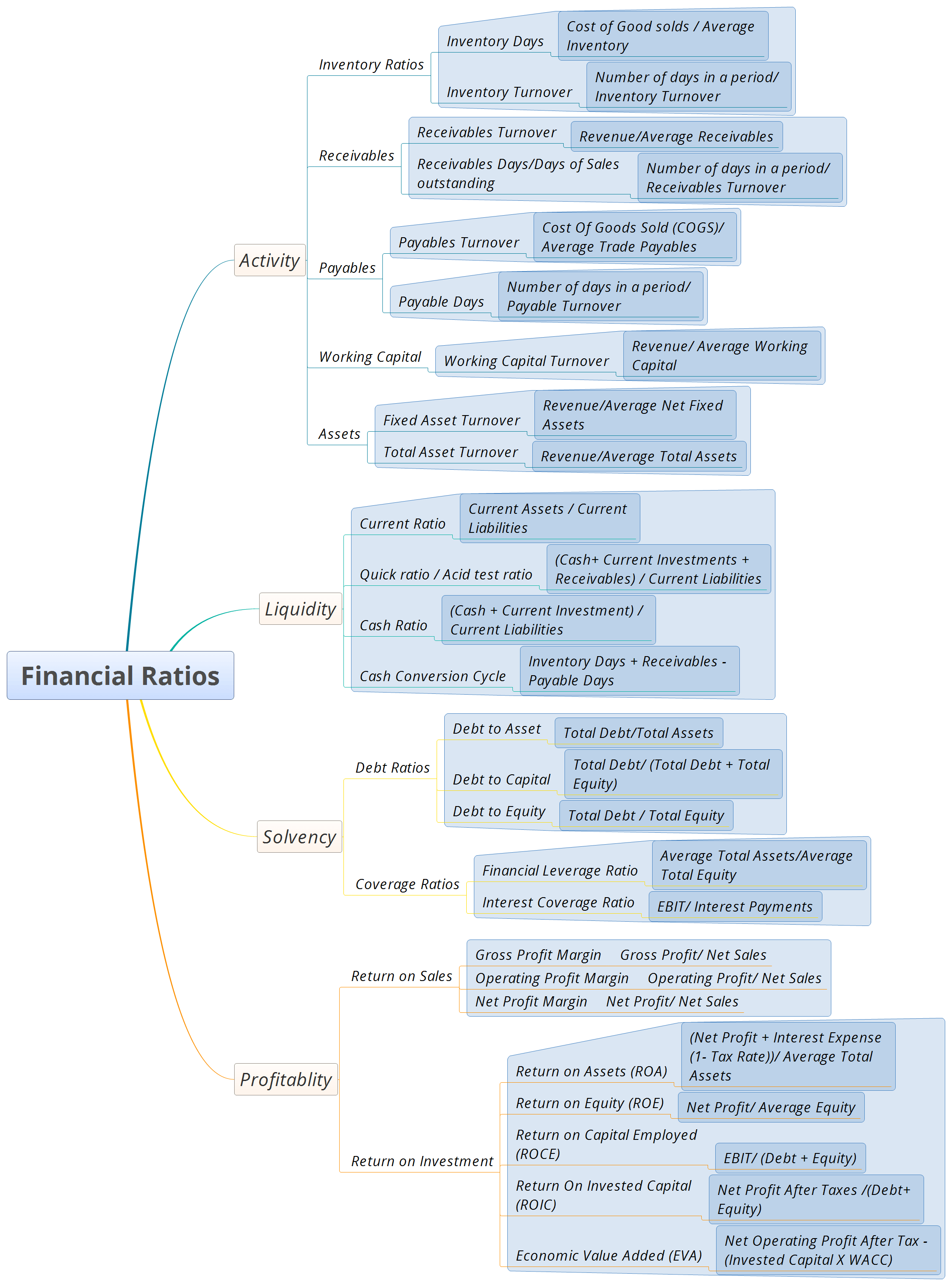

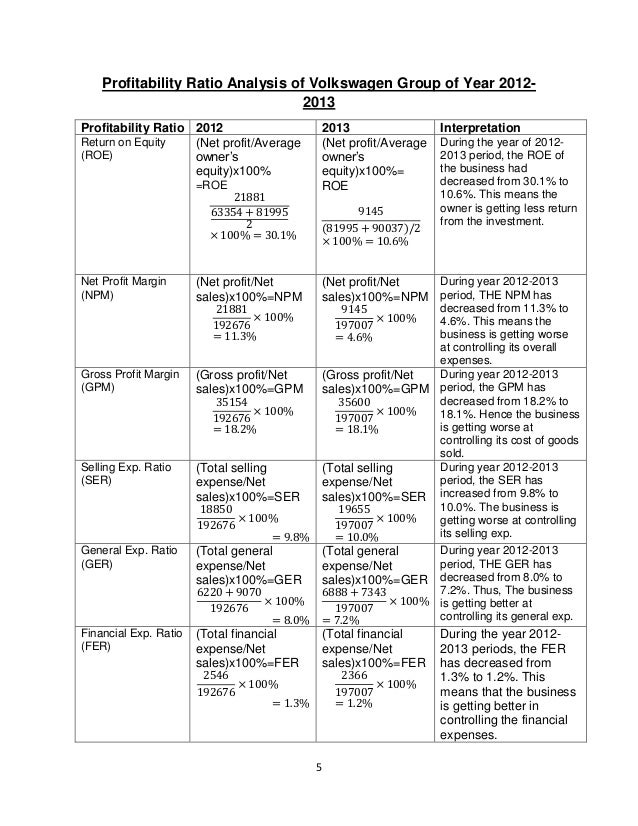

Financial ratio analysis compares relationships between financial statement accounts to identify the strengths and weaknesses of a company. Financial ratios are usually split into seven main categories: liquidity, solvency, efficiency, profitability, equity, market prospects, investment leverage, and coverage.

An introduction to financial ratios and ratio analysis

Analyzing Your Financial Ratios. Overview. Any successful business owner is constantly evaluating the performance of his or her company, comparing it with the company’s historical figures, with its industry competitors, and even with successful businesses from other industries.

What are accounting ratios? How they are calculated. Read detailed articles about accounting and financial ratios analysis.

FINANCIAL STATEMENT ANALYSIS Fundamentals, Techniques & Theory 2 – Chapter Two © 1995–2012 by National Association of Certified Valuators and Analysts (NACVA).All rights reserved.

Introduction to Financial Ratios. When computing financial ratios and when doing other financial statement analysis always keep in mind that the financial statements reflect the accounting principles.

When you’re research individual stocks for investing, you have to look beyond the basics like share price, number or shares, and market capitalization. Here are